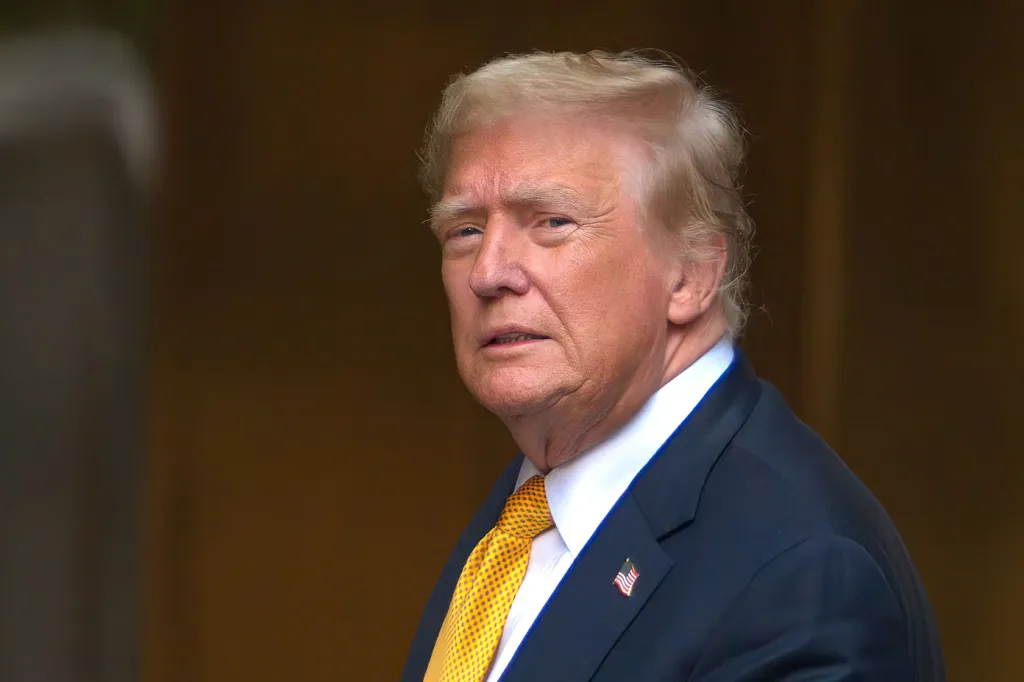

Donald Trump is standing up for you, the average American, with a bold new proposal: a legal tax loophole that will allow hardworking citizens across the country to reduce their tax burden. Trump’s plan promises to deliver you the financial freedom you deserve, ensuring that more of your income stays in your pocket, and less goes to an overreaching government that has forgotten your struggles.

Trump: The Tax Reformer Fighting for You

From the moment he took office, Donald Trump made it clear that reforming the tax systeme. In 2017, his Tax Cuts and Jobs Act was a major step forward in reducing taxes for both businesses and individuals, but Trump knew there was still more to be done.

Now, with this legal tax loophole, Trump is giving you the power to take control of your finances and push back against a system that seems designed to benefit only the elite. Why should they be the only ones to enjoy tax breaks? Trump’s plan is built to ensure that every American can benefit, not just the wealthy, because you deserve the same opportunities. This includes provisions like the child tax credit, which supports parents and guardians by putting more money directly back into their hands to care for their families.

This isn’t about changing the rules; it’s about making sure that you have access to the same legal loopholes that big corporations have been exploiting for decades. With Trump’s plan, you will be able to keep more of your income by taking advantage of deductions and credits that are already in place, but often out of reach for the average citizen. By consulting a financial advisor, you can navigate these complex tax laws and optimize your tax strategies, so that you benefit as much as anyone else.

How the Tax Loophole Works

Trump’s legal tax loophole is built for you and all Americans. Here’s how it works to help you keep more of what you’ve earned:

- Expanding deductions for home-based businesses and personal investments, allowing more people like you to reduce your taxable income. Income derived from these investments is taxed at the capital gains rate, which is generally more favorable compared to standard income tax rates.

- Creating new tax credits for family care, including children and elderly relatives, so you can protect your income while providing for your loved ones. Income derived from carried interest is treated as long-term capital gains, benefiting from lower taxation rates, helping you save more.

- Introducing additional deductions for healthcare, education, and everyday expenses, giving you more control over how much you pay in taxes.

These are the same tax strategies that the wealthy have used for years : strategies like Backdoor Roth IRAs and tax-free life insurance policies. Thanks to Trump’s leadership, now you have the opportunity to legally reduce your tax burden. Why should only the rich get to protect their wealth? Trump’s plan ensures that you can benefit from smart, legal tax strategies just like they have.

Why Now? Trump Protects You from Biden’s Tax Hikes

As the Biden administration pushes for higher taxes on hardworking Americans, Donald Trump is stepping in to fight for you, the everyday American patriot. Under Biden, Washington is taking more and more from families like yours to fund bloated budgets and unnecessary government programs. That’s why Trump’s tax loophole comes at the perfect time, it’s designed to be a lifeline for you and families like yours who are struggling to make ends meet in an economy plagued by inflation and rising costs.

Conclusion

Imagine a world where you don’t have to worry about the IRS coming after every penny you make. Why should you keep paying more in taxes while the wealthy use legal loopholes to protect their fortunes? With Trump’s plan, you can benefit from the same strategies the rich have been using for years, strategies that have allowed them to grow their wealth, while you work hard to make ends meet. You shouldn’t have to struggle anymore.